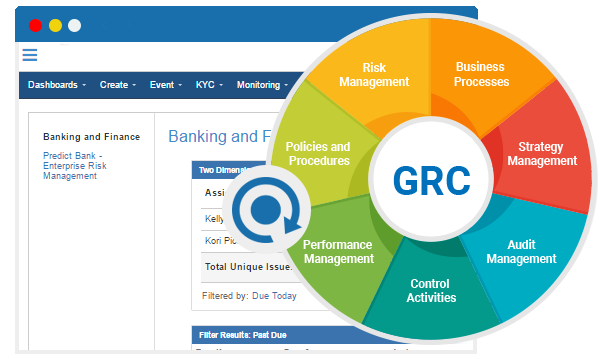

Manage Risk and Compliance Under an Integrated GRC Platform Powered by Artificial Intelligence (AI), GRC Streamlines Workflows and Automates Processes

BMDH is an enterprise risk, compliance intelligence, management technology and services company with operations across the African continent. BMDH partnered with international GRC experts to deliver A.I. powered Risk and Compliance intelligence solutions for banking and financial services organizations.

With our GRC software there is no need to ask anyone to make a report about a topic related to governance, risk, or compliance. All that the management needs to do is open the GRC application they use and they will be able to see the risk, compliance, and governance status of the whole organization.

With our GRC software there is no need to ask anyone to make a report about a topic related to governance, risk, or compliance. All that the management needs to do is open the GRC application they use and they will be able to see the risk, compliance, and governance status of the whole organization.

BMDH empowers organizations to accelerate profitability, innovation and productivity by predicting risks and streamlining compliance. Our GRC software solution is a Risk and Compliance intelligence platform augmented with artificial intelligence technology to predict and mitigate operational risks while streamlining regulatory compliance. It integrates regulations and obligations, compliance management, risks and controls, KRIs, audits and assessments, policies and procedures, and training in a single cloud-based SaaS platform based on artificial intelligence to provide predictive analytics and unique insights for predicting risks and streamlining compliance.

Our experts has provided risk and compliance solutions and regulatory training to various banks and financial services firms across the globe, and this experience and expertise has provided valuable insight into developing a next-generation risk and compliance intelligence solution that is easier to use, quicker to deploy, has a lower total cost of ownership and reduces our clients’ efforts in managing their compliance and regulatory requirements.

BMDH offers a full range of professional services to implement solutions meeting industry standard and customer specific requirements. Our services team follows a proven implementation methodology that provides a consistent approach for successfully creating, deploying and adopting a GRC solution.

Our professionals have deep industry knowledge and experience in the application of governance, risk, compliance and EHS best practices to customer solutions. Customers rely on our extensive and unique understanding of regulations and requirements, policies and procedures, risks and controls, issues and incidents, audit and inspections, and learning management.

Key Differentiators

Key Differentiators

BMDH’s key differentiator is that our solution is an integrated governance, risk and compliance (GRC) platform built on artificial intelligence, automating several functions while improving quality and value through a single platform. It creates risk relationships between those functions and provides visibility of where risk intersect, providing stakeholders a deeper, wider and holistic view of risk and compliance.

Our key differentiators include:

- Artificial Intelligence: With its unique mapping abilities and patent-pending Artificial Intelligence with Natural Language Processing technology, our solution semi-automates the process of determining the impact a changing regulation may have on your organization by automatically alerting users of regulatory changes or updates, visually identifying those changes, determining what may be impacted by those changes, and providing unique visibility into where risks intersect. This feature is highly unique and unmatched in the industry.

- Small and Mid-Market Target: We build and target our solutions for highly regulated industries. The small and mid-size segment requires easy to use and intuitive solutions, less implementation effort and quicker deployment timelines, and is very cost-sensitive whereas both initial and ongoing price is a major factor in the decision process. Our GRC solution is built for mid-market banking and financial services organizations, resulting in faster time-to-value and out-of-the-box solutions

- Multi-Tenant SaaS: True multi-tenant SaaS architecture minimizes IT resources and delivers implemented solutions faster than legacy vendors

- Business Intelligence: In-platform reporting, dashboard and analytics via a business intelligence (BI) engine that combines internal and external data with predictive analytics

- ABA Endorsement: Our GRC software solution partner is an exclusively endorsed solution provider for risk and compliance management by the American Bankers Association.

Today’s ERM Challenges

Legacy RCSA practices are time consuming and inefficient. The effort required to gather and evaluate risks, controls and inherent and residual risk is compounded by decentralized data and manual data entry and analysis. Further, a lack of standardization of risks or controls definitions results in:

Legacy RCSA practices are time consuming and inefficient. The effort required to gather and evaluate risks, controls and inherent and residual risk is compounded by decentralized data and manual data entry and analysis. Further, a lack of standardization of risks or controls definitions results in:

- Every industry faces a unique set of risk mandates and compliance challenges that require close coordination and integration with many related GRC functions including regulatory and standards compliance, incident management, work place investigations, internal audit, quality management and others.

- An organization faces risks on several fronts, including business and regulatory compliance. With regulations changing, markets shifting, and internal restructuring occurring, a strategic risk-based approach can minimize uncertainty.

- Organizations must be able to respond, predict and mitigate risks with agility in response to ever-changing business conditions as well as manage overall business risks under an umbrella of strategic risk-based culture.

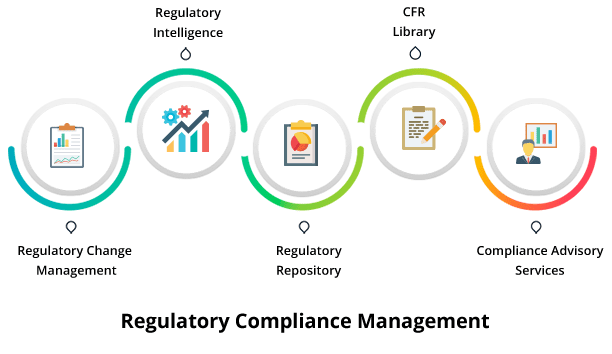

Regulatory Compliance Management

Our Regulatory Compliance Management Suite brings together next-gen regulatory change management technology, real-time regulatory intelligence, and repositories of vital regulatory data to help transform and optimize your organization’s regulatory compliance framework. The tools, plugins, and repositories included in the suite can be used in tandem for regulatory compliance or can be integrated into the Risk and Compliance Intelligence suite.

The Regulatory Compliance Management Suite includes:

- Regulatory Change Management

- Regulatory Intelligence

- Regulatory Repository

- CFR Library

- Compliance Advisory Services

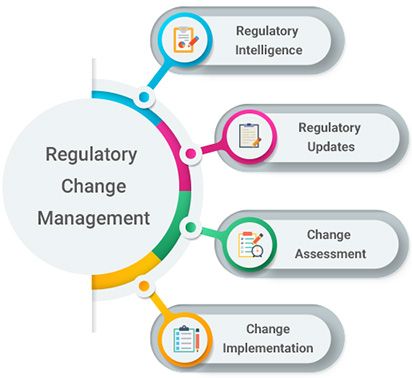

Regulatory Change Management

Regulatory Change Management

Our Regulatory Change Management application module enables organizations to track regulatory requirements, updates, changes, news and notifications, and then manage all activities and documents associated with those regulatory changes across the organization.

With its unique mapping abilities and Artificial Intelligence (AI) with Natural Language Processing (NLP) technology, Predict360 streamlines the process of regulatory change management (RCM) with enhanced regulatory knowledge, impact assessments, and change management workflows.

Regulatory Knowledge

- Providing a “news feed” that can display news and notification updates from a variety of external sources, including third parties such as Compliance.ai (available pre-configured as part of the optional Regulatory Intelligence (News & Notifications Feed) content plug-in), Thomson Reuters, Wolters Kluwer, RSS feeds, email-based notifications and any other information that the organization may want to automatically or manually load into our GRC software solution.

- Providing a mechanism to document if the change is applicable for the organization and providing an audit history of when the assessment was performed, by whom and if the change was applicable to the organization.

- If applicable to the organization, automatically initiating a regulatory change workflow process to determine the impact and manage the project plan to implement this change.

Impact Assessment

- Visually identifying what has changed between versions of the regulatory text

- Summarizing what needs to be completed based on the wording in the regulatory text

- Providing a central repository for any research performed on this regulatory change, such as regulatory change guidance and summary documents, industry association newsletters and links to websites with information regarding the regulatory change.

- Determining what artifacts within the organization may be impacted by those changes, such as policy & procedure documents, training classes, risks, controls, assessment checklists, compliance monitoring & testing activities, audits and/or any compliance activities within the organization that is related to this regulation.

Change Management Workflows

- Creating and managing the implementation/project plan and all associated tasks and activities, including coordinating activities across the entire organization, business units and product lines. Due dates, notifications/escalations and assignment of sub-tasks are all supported.

- Notifying all relevant parties across the organization associated with that regulation of the regulatory change/update, including important information such as effective dates, due dates, supporting documentation on the change and/or what needs to be done as well any other external documents or information links available regarding that regulatory change.

- Provide evidence of all activities and documentation associated with regulatory updates, even including regulatory changes that were read but determined not applicable to the organization.

Regulatory Repository

Our GRC software provides a repository that can capture all an organization’s obligations, including regulatory requirements, business requirements, standards, and frameworks that the organization needs to comply with. This repository allows the organization to link all their policy & procedure documents, risks and controls, training programs, audits and assessments to these obligations and regulations. This functionality enables the organization to identify gaps where they might not be meeting their regulatory obligations, identify risks to the organization and to quickly understand and assess the impact of a change in a regulation or obligation.

This module also includes proprietary artificial intelligence (AI) technology using natural language processing (NLP) technology to categorize a regulatory requirement to a particular subject area as well as to identify the second and third-party requirements based on the regulatory text (effectively the “who” and the “what” should be done).